It is not

long now till the end of the financial year.

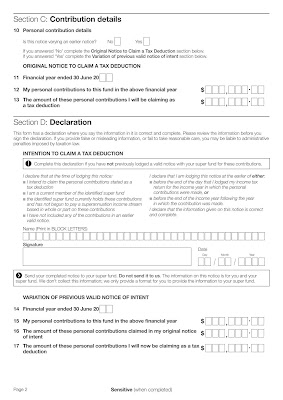

Now is the time to think about what opportunities and strategies are

available to improve your financial position.

If you’re

planning on contributing to super, you may be eligible for a tax deduction for

the current financial year provided you do so prior to June 30.

If you hold

investments such as a rental property or managed funds and have used investment

debt to purchase them, you may choose to pre pay the next 12 month’s interest. This may allow you to bring forward those

deductions and use them this year.

This could

prove to be a wise strategy if you don’t have sufficient deductions for the

year - particularly if you find yourself in the highest tax bracket.

No one

likes paying tax, however if you’re paying tax it means you’re earning money

which is a positive thing. It’s paying

“unnecessary” tax that we should avoid.

Don’t let

these next weeks left of June simply be about having to endure those annoying

“EOFY runout sale” ads on TV.

Use the

time wisely. If you leave it until July

1st, it’s too late. The

above tax strategies can’t be applied retrospectively. Of course, any tax planning strategy needs to

be considered in relation to your individual circumstances.

At

Hindsight we’ll be working hard during this busy period to help our clients

achieve their financial goals. Would

discussing your tax game plan be valuable to you?

Hindsight

Wealth can complete a complimentary and confidential Statement of Advice for

your financial health. No

obligation. Yours to keep no matter

what.

Let’s get

you on track for the start of the new financial year.

Andrew O’Brien and Hindsight Group Pty Ltd t/as

Hindsight Wealth Pty Ltd (ABN 88 168 442 528) are Authorised Representatives of

Affinia

Financial Advisers Limited ABN 13085335397 & AFS Licence No 237857. The

material contains general advice only and the consumer should consider the PDS

and whether the product is appropriate prior to deciding to buy.

Comments

Post a Comment